A survey on the potential research and development tendency in the Italian and Serbian feed industry

2University of Novi Sad, Institute of Food Technology, 21000 Novi Sad, Bulevar cara Lazara 1, Serbia

ABSTRACT

This study investigates potential areas for research and development in the feed sectors in Italy and Serbia. A questionnaire was submitted to 113 feed companies, 37% of these answered. Frequency statistics, data graphs and Simple Correspondence Analysis was obtained. Results indicated that 7% of responders in Italy and 47% of Serbia have not planned any budged for research and development in the last 3 years. The industrial processes were the main focus for Italy, while new product developments for Serbia. For both countries will be essential in the near future increase in product quality, search for new markets and reduction of energy consumption. Additionally, it was observed that company dimension is linked to the area/focus of innovation, irrespective of the type of feed production.Introduction

Worldwide the consolidation and intensification of the feed industry has resulted in more tons produced from fewer feed mills. In the European Union between 2005 and 2010, the feed mill size has increased from approximately 10,000 tons to 50,000 tons per feed mill per year, with the number of feed mills decreased by 80%. This trend has been mirrored in the US, and even in China, where the number of feed mills has dropped from over 15,000 to 10,000. The industrialization of the feed sector has resulted in an increased specialization and efficiency of manufacturers and suppliers (Connelly, 2013).

A further feature of the feed industry today is its competitiveness. In this respect, feed cost is determined by four components: the cost of raw materials (approximately 70% of the overall cost of feed), labor costs, energy price, and depreciation of milling facilities. Accordingly, feed companies are intensifying their commitment to innovation, which is considered the key to sustainable food security. Through innovation, the feed industry can improve resource-efficiency, adapt to trade change, and improve food safety, diversity and quality while maintaining the competitiveness of the Agri-food sector and creating more and better jobs in rural areas (Hogan, 2015).

Looking at the European scenario, the EU-28 contributes for 16% of global feed production (FEFAC, 2014). The European feed sector is the most important agricultural input industry in Europe and is an essential supply partner to the livestock industry (EUFETEC, 2013). As reported in the latest review of livestock production and trade, more than 190 million tons of meat, milk and eggs were produced in the EU. To sustain this scale of livestock production, UE-28 consumes 477 million tons of feed a year, of which one third (155 million tons) is supplied by compound feed manufacturers (FEFAC, 2014; Pinotti et al, 2014). In spite of these figures, the livestock sector in general, and the feed sector specifically, need to take into account several new challenges such as environmental impact, scarcity of raw materials, and societal acceptance. A common denominator among many of these issues, which are often politically-sensitive, is not only sustainability, but also innovation (Geraldine, 2014). Indeed, accelerated Research and Technology Development – based on an innovative approach – will be crucial in order to develop feed solutions able to guarantee the EU livestock sector, remains competitive and sustainable in the global market (EUFETEC, 2013; EFMCE, 2014).

The EU market today, and the world market tomorrow, is expressing new social needs and challenges. In fact, the demand for animal products is a challenge for animal production and nutrition. This challenge requires an innovative approach in livestock nutrition and feeding of even greater and faster. Thus, even though, the knowledge in animal nutrition and feeding is solid and robust, based on several decades of research and development, further innovation in animal nutrition and feeding (Magnin and Picot, 2015), that includes feed technology, are needed. These are the reasons behind the FEEDNEEDS project, an Italian-Serbian bilateral project, funded by the Italian Ministero degli Affari Esteri e per la Cooperazione Internazionale. Both countries are important in the EU feed industry panorama: Italy is the sixth country for compound feed production in the European Union, and Serbian feed production is one of the largest in the Balkan area. The objectives of this survey-based study were to: i) investigate potential areas for research and development in the feed sectors (i.e. research needs); ii) prioritize the most important elements of the research and development in the feed sector; and, iii) obtain stakeholders’ opinions on how to integrate the elements determined to be most valuable by the survey into practices.

The answers to these questions will inform the feed associations and companies within the feed sector and will generate more innovative and valuable research.

MATERIAL AND METHODS

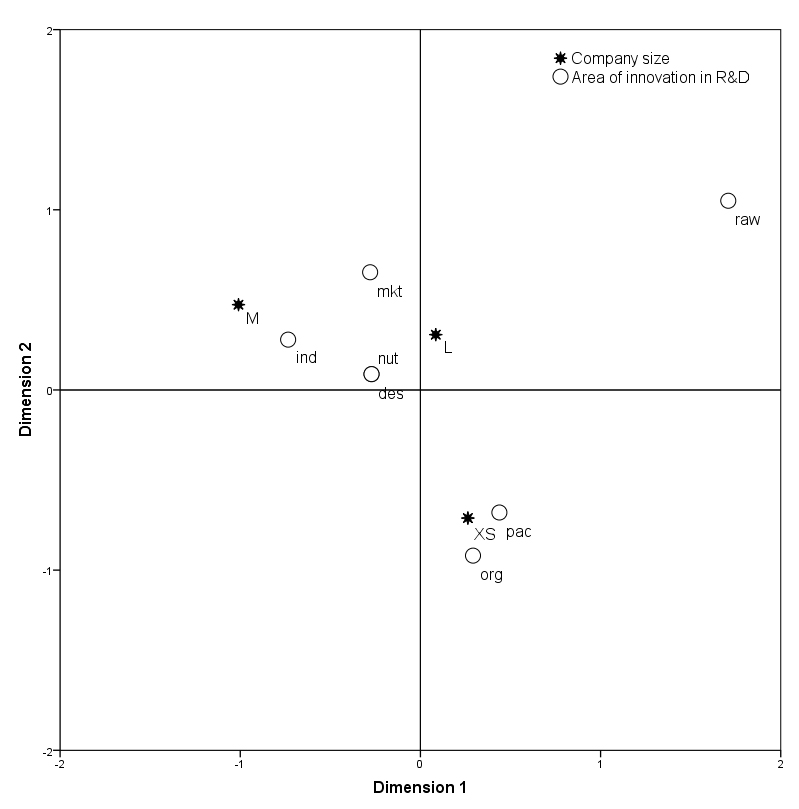

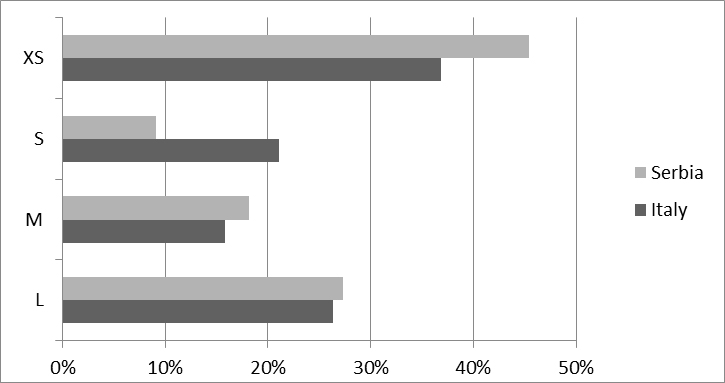

In the frame of a bilateral project between Italy and Serbia a survey was conducted between 2014 and 2015. A questionnaire containing 29 questions (Tab. 1) was developed and sent to 113 feed companies in Italy and Serbia. The companies have been randomly contacted starting from regional trade association database. The questionnaire was sent to Italian and Serbian feed companies operating in different markets (farm animals and pet animal nutrition), and based in two main regions Po valley for Italy and Vojvodina for Serbia. The companies have been invited to define their dimension according to the following classification: extra small, small, medium and multinational companies (referred to later as XS, S, M, L); the distribution relative to the company classes’ in Serbia and Italy is reported in Figure 1. The questionnaire was based on three main sections: i) Company Overview (CO); ii) Products and Process Features (P&P); iii) Research, Development and Innovation (R&D). The elements for each dimension (CO, P&P and R&D) and their corresponding questions were selected using contributions from in-house experts in feed technology, feed and animal nutrition, and economic science. Briefly, as reported in Table 1, company overview included general information, namely year of foundation, company size and owner profile. Types of feed production (monogastric or ruminants), production plant machinery, list of feed additives used, and so forth, were covered by the P&P section. Finally, R&D included the area of innovation, perceived difficulties (e.g. economics and bureaucracy), projects in the past and present, and consistency of a dedicated budget to R&D.

Figure 1. Distribution relative to the company classes in Serbia and Italy. XS = extra small; S = small; M = medium; L = multinational companies

Figure 1. Distribution relative to the company classes in Serbia and Italy. XS = extra small; S = small; M = medium; L = multinational companiesStatistics

Recorded data were analyzed using two different approaches: descriptive statistics and simple correspondence analysis. Specifically, data collected by open response and multiple-choice answers in each section (CO, P&P and R&D), were processed in order to obtain frequency statistics and graphs of the data. Furthermore, in a specific set of questions a simple correspondence analysis was performed. For this purpose, companies were grouped according to their size (see below) and type of production (feed for monogastric, ruminant, or both) in order to highlight the relationships between these features and the areas of innovation in R&D (source/type of raw materials, product design, industrial process, packaging, marketing, nutritional content of the product, company organization) in which they have been most innovative in the last 3 years. Companies are classified in four categories: extra small (XS – less than 20 employees), small (S – 21 to 50 employees), medium (M – 51 to 100 employees) or large (L – more than 100 employees). Companies were also classified in four categories by type of feed production: monogastric, ruminant, both, or no answer. A simple correspondence analysis with a symmetric normalization model (Beh, 2004; Hoffman and Franke, 1986; Lebart et al, 1984) was performed using the statistical software SPSS 22.0. This multivariate statistical method is suitable for exploring relationships between items of two nominal variables. Accordingly, in the present study in the correspondence analysis, the company dimension and the type of feed production (monogastric vs. ruminant) of each company and the areas in which they have most innovated in the last 3 years were considered. Differences or similarities can be interpreted looking at the position of points in a Cartesian plane, called a biplot. Briefly, the closer the points are in the plots, the more similar they are considered. In fact, statistically they are close, because they contribute to the constructions of the same dimension of the graphs. As explained in Gaviglio et al. (2014, 2015), results are discussed considering: inertia, mass, contribution to dimension, squared correlation and quality of each point. The inertia of the dimension represents the Eigenvalue, and reflects the relative importance of each dimension of the biplot. The mass measures the frequency of each couple of variables in interviewers’ answers. Contribution to dimension indicates the importance of each point to the dimension considered. The coordinates of the point, by definition, are the distance of each point from the origin of the plot, and indirectly indicate if the considered variables are significantly correlated with each other. Finally, squared correlation approximates the accuracy of a point in constructing the axis, while quality approximates the accuracy of a point considering the whole biplot.

|

COMPANY OVERVIEW |

Year of foundation: |

Single answer |

||

|

|

Company dimension: N° of Workers/ employees (average value, including owners and partners) |

Single answer |

||

|

|

Owner Profile Gender: · Male · Female Age: |

Multiple choice

Single answer |

||

|

PRODUCTION AND PROCESS CHARACTERISTICS |

The production is mainly based on the use of: |

|

||

|

· Raw materials · Premixes · Finished products from third part |

Multiple choice |

|||

|

|

Indicate type of feed production: |

|

||

|

|

· Poultry (monogastric) · Pig (monogastric) · Dairy cow (ruminants) |

· Beef (ruminants) · Other: fish, rabbits, pet (monogastric) |

Multiple choice |

|

|

|

Do you include of feed additives? Indicate which: |

|

||

|

|

· Vitamins and microelements · Antioxidants · Flavouring · Emulsifiers, stabilizers, etc. · Pigments · Preservatives |

· Binders · Acidity Regulators · Enzyme · Probiotics, yeast · None |

Multiple choice |

|

|

R&D AND INNOVATION |

In the PAST |

|

||

|

|

Has a budget been created for research and development (R & D) in the last three years? |

|

||

|

|

· No · Yes, using external resources (money and personnel) · Yes, using internal resources (money and personnel) |

Multiple choice |

||

|

|

What are the areas in which you have most innovated? |

|

||

|

|

· Procurement of raw materials · Marketing and advertising · Product design · Nutritional content of the product · Especially for pet food or other · Company organization · Packaging (especially pet food or other) |

Multiple choice |

||

|

|

In the FUTURE |

|

||

|

|

Have you planned an expansion of production in the coming year? If yes, which of the following actions have you taken to empower your line? |

|

||

|

|

· New products · Newmarket/trade · New technologies · New suppliers

|

· Extension of choice · Packaging (e.g. pet food) · Other |

Multiple choice |

|

|

|

What are the main aims of innovation activities? |

|

||

|

|

· Satisfy a growing market demand · Comply with regulations · Distribution requirements · Ethical Issues · Enter in new markets · Improve profit · Personal orientation of owner towards innovation · Cost reduction · Improve market position · Reduced environmental impact · Improve quality · Security · Decrease energy consumption |

Multiple choice

|

||

|

|

What are the main difficulties to your innovation activities? |

|

||

|

|

· Lack of new ideas · Lack of technical knowledge · Lack of innovation opportunities · High cost for innovation · Organizational problems · Lack of government incentives · Regulations too restrictive · Paper work, bureaucracy |

Multiple choice |

||

|

|

What are the sectors in which you will invest in the next five years? |

|

||

|

|

· Dairy cow · Beef cattle · Pigs |

· Poultry · Pet · Other species |

Multiple choice |

|

|

|

In what areas do you expect the next investment over the next five years? |

|

||

|

|

· Research and development of new · Extension/ upgrade of the production line · New production technologies · Control of production processes · Compliance with legislative requirements · Advertisement · Transport systems · Safety of installations/systems |

Multiple choice |

||

Results and Discussion

One hundred and thirteen feed companies were contacted. Of these, 37% contributed by filling out the questionnaire, which generated 464 data points for Italian (IT), and 319 records for Serbian (RS) feed companies. The largest contribution was from small companies (45% of total responses) and least from medium company (40% of total responses), indeed this scenario is representative of the actual feed sector in both countries.

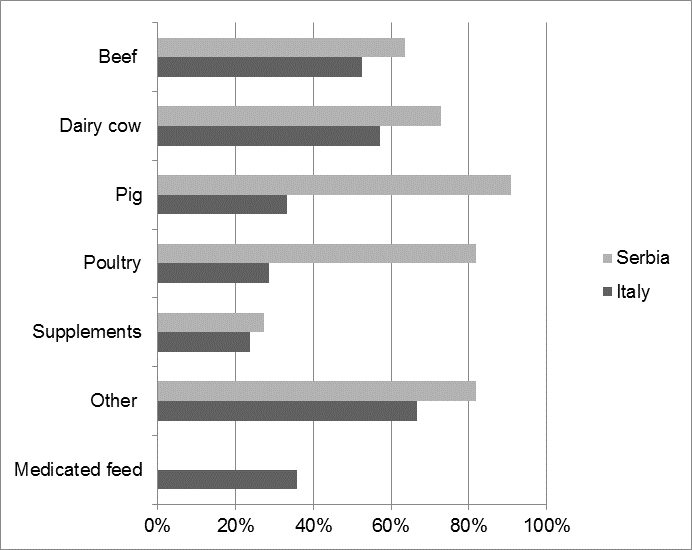

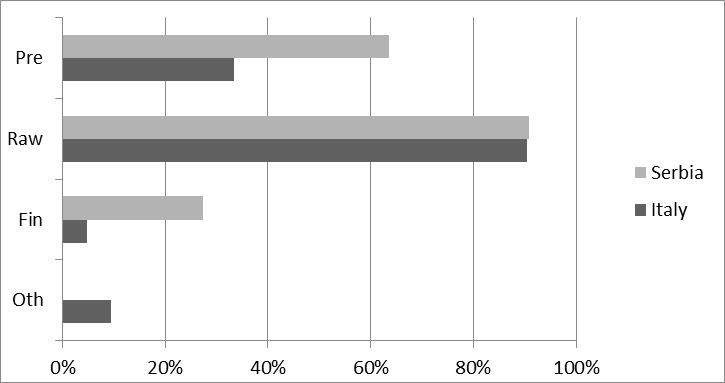

The results are presented as CO, P&P and R&D. Regarding the CO, the results obtained indicated that Serbian firms are more recently founded than the Italian ones (mean ± SD, 1980 ± 30 and 2000 ± 14 years, for IT and RS respectively). Serbian industries are led by males (100%), by contrast, Italian industries are led by both genders (63% and 38% for male and female, respectively). In both countries feed production is based mainly on the use of raw material (Fig. 2), such as ground corn and soybean meal. Italian industries consulted were mainly focused on ruminant feed production, whereas those in Serbia produce feed for all species (Fig. 3).

Figure 2. Type of products used by the Serbian and Italian feed companies as base ingredients for feed production

Figure 2. Type of products used by the Serbian and Italian feed companies as base ingredients for feed productionIn both countries, the use of feed additives is a common practice: 91% and 90% of responders (Italian and Serbian, respectively) use feed additives in their formulations. When types of additives are considered, some differences in specific groups of additives have been observed in both countries (Fig. 4). The main differences were observed for antioxidants, enzymes, probiotics and flavouring, though precise information within each class was not recorded.

These differences could be related to differences in the species for which compound feed is produced.

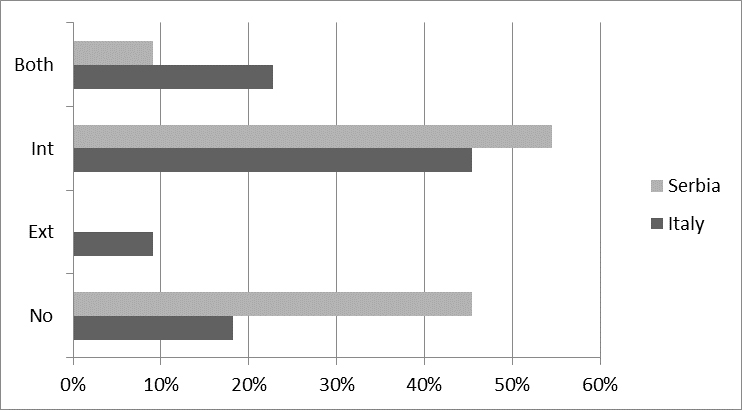

Considering R&D in the past (Fig. 5), 18% of Italian responders had not planned any budget for R&D, while for Serbian industries this percentage reached to 45%. The main reason for this difference can be attributed to the fact that in both countries informal activities in R&D have been done in the past and their proportion could have been higher in Serbia than in Italy.

Both= yes using external and internal resources; Int= yes, using internal resources (money and personnel); Ext= yes, using external resources (money and personnel); No= none R&D.

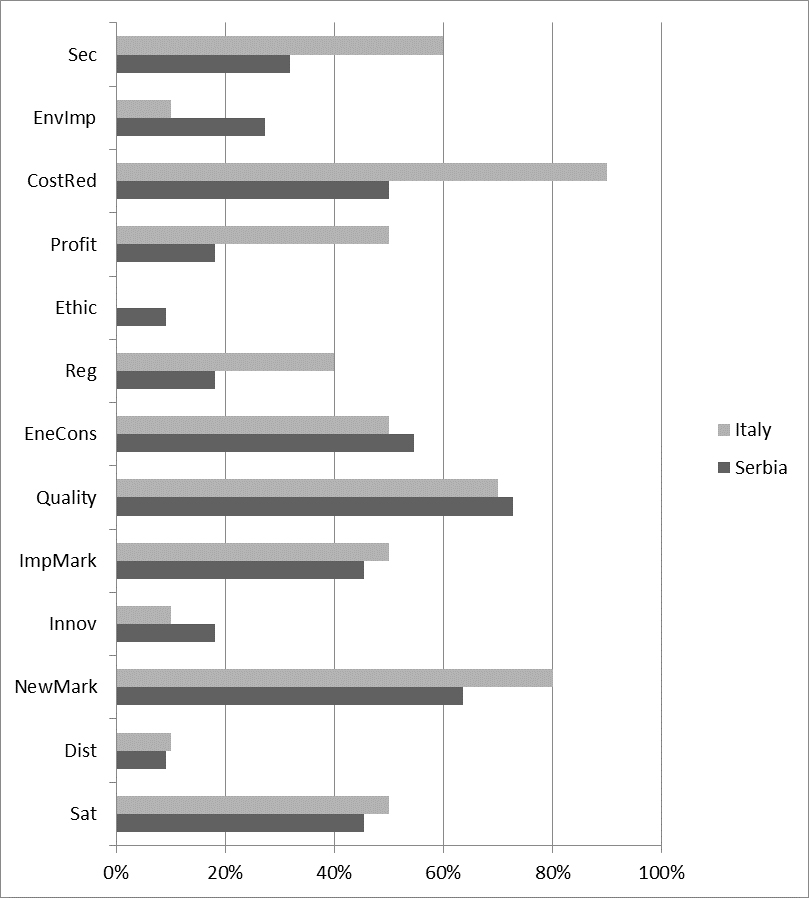

When the R&D activities were tested, 64% of Italian responders chose industrial processes as one of their activities, while 82% of Serbian activities participate in new product development.

For both countries, market strategies are important. The majority of companies have reported that product quality, market image, new markets, and the safety of those markets are a part of their innovation activities. The main differences between Italian and Serbian industries are related to efficiency, including security, profit and cost reduction (Fig. 6). These differences could be due to the more recent establishment of the Serbian companies.

Sec= security; Envimp= reduced environmental impact; CostRed= cost reduction; Profit= improve profit; Ethic= ethical issues; Reg= comply with regulations; EneCons= decrease energy consumption; Quality=improve quality; ImpMark= improve market image; Innov= personal orientation of owner towards innovation; NewMark= new market; Dist= distribution requirements; Sat= satisfy a growing market demand.

In general, these observations seem to reflect the different maturities and priorities of the feed market in the two tested areas. About 20% of the feed industries consulted will not make any investment in R&D in the near future (next 3-5 years), but there will be unofficial R&D. This feature is common for both countries, contrary to the differences in past investment. This discrepancy with the past is probably due to the need of Serbian companies to adapt their current production to the new markets, like the EU, which require new regulations, quality and safety standards. When type of feed production (monogastric, ruminants, etc.) was considered, research and development of new products in the dairy and beef cattle and pet sectors, were the main investment areas in which Italian companies will invest in the next 3-5 years. The Serbian scenario looks like the Italian one, with regard to research and development of new product, extension/ upgrade of the production line, new production technologies and control of production processes. The only exception is the investment on advertisement.

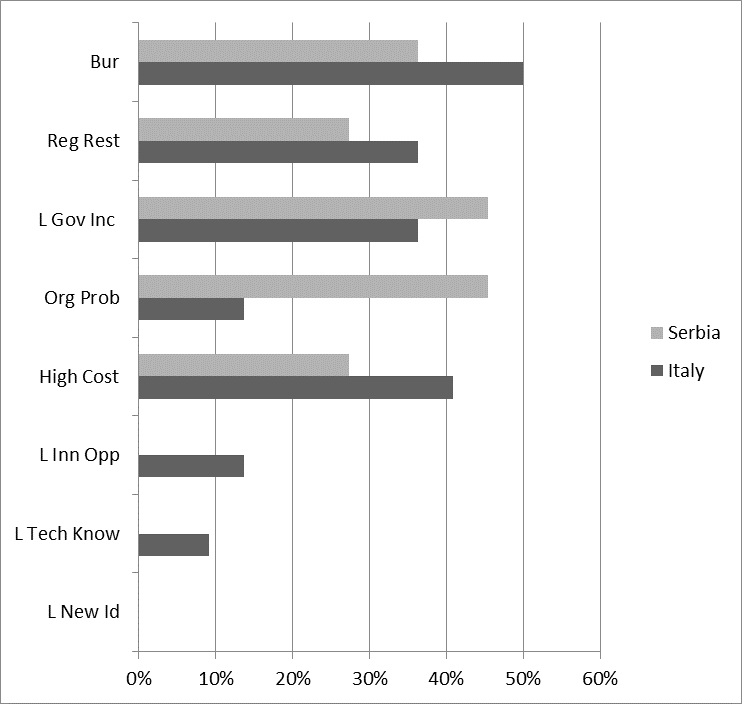

Bur= Paper work Bureaucracy; Reg Rest= regulations too restrictive; L Gov Inc= lack of government incentives; Org Prob= organizational problems; High Cost= high cost for innovation; L Inn Opp= lack of innovation opportunities; L Tech Know= lack of technical knowledge; L New Id= lack of new ideas

The high cost of innovation, paperwork/bureaucracy, regulation too restrictive and lack of government incentives, were the main difficulties met in both countries (Fig. 7). Whereas considering the main difference in the two countries, existence of organizational problems was characteristic for the Serbian companies.

The data of the correspondence between the company size and the areas of innovation in the last 3 years are shown in Table 2, the graphical representation is presented in Fig. 8. A significant correspondence (P < 0.05) was found among the considered categories, i.e. between Company size and R&D target. The first two dimensions account for 87.5 % of the total inertia, using a considerably satisfactory quota of the raw information.

|

Category |

Mass |

Coordinate |

Inertia |

Contribution to |

Squared correlation |

|||||

|

dimension |

||||||||||

|

1 |

2 |

1 |

2 |

1 |

2 |

Quality |

||||

|

Company size |

||||||||||

|

XS |

0.361 |

0.263 |

0.711 |

0.080 |

0.060 |

0.501 |

0.129 |

0.829 |

0.958 |

|

|

S |

0.012 |

4.108 |

2.877 |

0.131 |

0.489 |

0.273 |

0.646 |

0.278 |

0.925 |

|

|

M |

0.181 |

-1.010 |

0.473 |

0.103 |

0.443 |

0.111 |

0.744 |

0.143 |

0.888 |

|

|

L |

0.446 |

0.085 |

0.307 |

0.035 |

0.008 |

0.115 |

0.038 |

0.432 |

0.470 |

|

|

Area of innovation in R&D |

||||||||||

|

Raw |

0.084 |

1.709 |

1.050 |

0.139 |

0.592 |

0.255 |

0.735 |

0.244 |

0.978 |

|

|

Des |

0.157 |

-0.271 |

0.088 |

0.005 |

0.028 |

0.003 |

0.889 |

0.082 |

0.970 |

|

|

Ind |

0.181 |

-0.734 |

0.280 |

0.060 |

0.234 |

0.039 |

0.677 |

0.086 |

0.763 |

|

|

Pac |

0.133 |

0.438 |

-0.681 |

0.038 |

0.061 |

0.168 |

0.278 |

0.590 |

0.868 |

|

|

Mkt |

0.120 |

-0.279 |

0.653 |

0.042 |

0.023 |

0.141 |

0.093 |

0.447 |

0.540 |

|

|

Nut |

0.157 |

-0.271 |

0.088 |

0.005 |

0.028 |

0.003 |

0.889 |

0.082 |

0.970 |

|

|

Org |

0.169 |

0.292 |

-0.920 |

0.060 |

0.035 |

0.391 |

0.100 |

0.870 |

0.970 |

|

XS= extra small company; S= small company; M= medium company; L= large company; raw= procurement of raw materials; des= product design; ind= industrial process; pac= packaging; mkt= marketing and advertising; nut= nutritional content of the product; org= company organization

The biplot in Fig. 8 shows a substantial differentiation among company size categories. In general, all categories, i.e. XS, M, and L, were clearly distinguished one from the other. This difference was exacerbated in the case of S category that was the smallest category considered in the study. By contrast, the L category was placed close to the origin, indicating a limited distinguish from the others. Combining company dimension and areas of innovation, it was observed that the XS category was extremely close to packaging (pac) and organization (org) points. This result indicates that XS firms have the most similarity innovation in pac and company org. By contrast, M is close to ind, indicating that medium firms have most innovation in industrial process. Large firms differ in the first two categories; indeed, as shown in the biplot, L is placed close to des and nut indicating that in the recent past, they have innovated in product design (des) and nutritional content (nut).

Looking at the correspondence analysis figures (Table 2) XS and L reported a mass value of 0.36 and 0.45 respectively. As reported by Hoffman and Franke (1986) the mass is a weight of the number of times each variable has been reciprocally connected by responders. Accordingly, we can observe that XS and L are the most represented categories. On the other hand, the mass value of S was very low, probably due to the sample size. Considering the contribution to the dimension of pac and org, in dimension 2, they account together for more than 0.42 indicating that packaging and company organization are both strategic in defining research and development in XS firms. Worth noting is that the category of raw, research and development devoted to new ingredients, was characterized by high contribution to dimension and low mass value. This combination would suggest that even though raw material can be considered relevant in defining the position in the biplot (contribution to dimension) its mass is very low. This last observation indicates that few companies in all categories have innovated in raw material supply and use in the last 3 years.

The data for the correspondence between type of production and the areas in which they have done the most innovation in the last 3 years are shown in Table 3 and graphically presented in Fig. 9. In this case no significant correspondence (P > 0.05) was found among the categories considered. Nevertheless, the first two dimension account for 81.6 % of the total inertia. The map in Fig. 9 does not show any substantial differentiation among company categories (type of feed production). Indeed, most of the points are condensed in a singular area indicating no differentiation. Moreover, NOANSWER and RUM are isolated from the others indicating no correspondence with any points.

|

Category |

Mass |

Coordinate |

Inertia |

Contribution to |

Squared correlation |

|||||

|

dimension |

||||||||||

|

1 |

2 |

1 |

2 |

1 |

2 |

Quality |

||||

|

Type of feed production |

||||||||||

|

MON |

0.292 |

0.289 |

-0.588 |

0.050 |

0.065 |

0.371 |

0.183 |

0.553 |

0.736 |

|

|

RUM |

0.079 |

-1.941 |

-0.553 |

0.119 |

0.792 |

0.088 |

0.929 |

0.055 |

0.984 |

|

|

BOT |

0.573 |

0.193 |

0.235 |

0.029 |

0.057 |

0.116 |

0.277 |

0.299 |

0.576 |

|

|

NOA |

0.056 |

-0.754 |

1.434 |

0.064 |

0.085 |

0.425 |

0.186 |

0.489 |

0.675 |

|

|

Area of innovation in R&D |

||||||||||

|

Raw |

0.090 |

-0.846 |

-0.616 |

0.040 |

0.172 |

0.125 |

0.602 |

0.232 |

0.834 |

|

|

Des |

0.146 |

0.595 |

-0.067 |

0.023 |

0.138 |

0.002 |

0.825 |

0.008 |

0.833 |

|

|

Ind |

0.180 |

0.264 |

0.658 |

0.031 |

0.033 |

0.286 |

0.150 |

0.679 |

0.828 |

|

|

Pac |

0.135 |

0.666 |

-0.900 |

0.063 |

0.160 |

0.402 |

0.354 |

0.472 |

0.826 |

|

|

Mkt |

0.124 |

0.563 |

0.314 |

0.035 |

0.105 |

0.045 |

0.421 |

0.095 |

0.516 |

|

|

Nut |

0.157 |

-0.606 |

0.432 |

0.034 |

0.154 |

0.108 |

0.635 |

0.234 |

0.869 |

|

|

Org |

0.169 |

-0.726 |

-0.228 |

0.036 |

0.237 |

0.032 |

0.932 |

0.067 |

0.999 |

|

MON= monogastric; RUM= ruminant; BOT= both; NOA= no answer; raw= procurement of raw materials; des= product design; ind= industrial process; pac= packaging; mkt= marketing and Advertising; nut= nutritional content of the product; org= company organization

In general combining different results and answers obtained in the present survey, it can be suggested that, as expected, the main concerns in both countries are related to the economic balance between production cost and benefit. Indeed, the research and development needs manifested by the survey are focused on: cost reduction, decreased energy consumption, improved quality, improved market image, development of new markets and satisfying market demand. Some small differences exist between the two countries probably due to maturity of market in Italy and its potential in Serbia. This seems to be confirmed by the Italian responders for whom the product quality is a further aspect that has been considered for R&D. However, matching the “innovation” needs manifested in the present study with literature and position paper from feed sector and its associations (FEFAC, 2014; Connely, 2013), it is evident that some differences exist. Innovation in technological advance, novel ingredients, feed safety, implementation of automation, and sustainability, are the key factors not only for feed associations (e.g. FEFAC) but also for the multinational and big industries with a predominant role in the feed market (Connely, 2013). In the present study however, the implementation of automation which has been proposed as one of key element in innovation for producing more feed ensuring traceability, quality and biosecurity, has been not mentioned by companies involved in the survey. Aspects such as automation in combination with other technological advance in the feed plants like real-time automated verification systems, which have been considered as milestones for the feed industries (Connelly, 2013), were mentioned neither by IT nor RS feed companies. These discrepancies can be attributed to the sampled companies which were mainly small and medium dimension. In this segment of the feed sector therefore the research and development needs are more “basic” and focused on the products, and the main inputs (raw materials, energy etc.). Obsolescence of the machineries and/or of the feeding plant is still relevant but probably not in a short-term period, as reported in the administered questioners.

Conclusions

The feed cost represents the major item in the cost of animal production. Without doubt, efforts will continue to refine feed processing techniques to reduce the cost of feed and to increase the value of feed for a target animal.

In some cases, changes in feed processing technology will be dictated, not by animal response, but by other motivations such as regulatory guidelines or human health concerns.

Although additional validation is necessary, our results indicate that in both countries surveyed the feed sector is interested in R&D in the near future. In general, keyftable aspects for innovation in both countries were essentially referred to refine feed processing techniques to reduce the cost of production, and to increase the market share. As expected, it was observed that innovation area is related to companies’ dimension. This aspect is evident especially for extra small companies for which R&D and innovation needs are quite basic. However, no correspondence has been observed between type of production and area of innovation. Thus even though, the possibilities for improvements in feed processing are infinite, each innovation is carefully weighed against company dimension and demonstrated improvements in feed production process.

АCKNOWLEDGEMENTS

This study is part of the FEEDNEEDS project a GRANDE RILEVAZA Italian-Serbian bilateral project funded by the Italian Ministero degli Affari Esteri e per la Cooperazione Internazionale. Coordinated by Prof. Luciano Pinotti, Università degli Studi di Milano, Italy.